What should I do when I suffer an accident and I do not have any type of insurance?

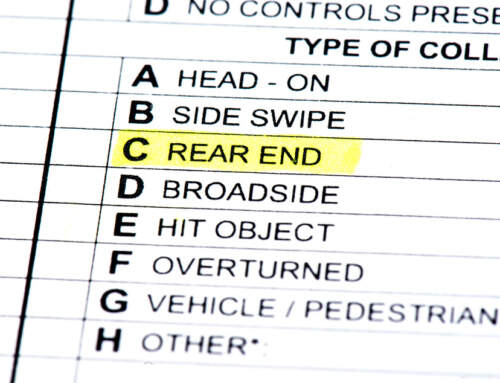

When there is an injury in a car accident that is caused by the negligence of another driver, it is possible to file an injury claim against that driver's auto insurance. Many more related questions may arise here.

- What happens if that driver doesn't have insurance?

- If the driver has insurance but his injuries and bills are much more expensive than what his insurance covers?

- What happens if the owner of that car that hit you didn't pay their insurance and your car is stolen at the time of the accident?

One of the main requirements of the law in Georgia is that every vehicle must have insurance of a minimum of $25,000 per person and $50,000 per accident. There are numerous situations where the responsible driver did not have any liability insurance or was driving a stolen vehicle; It may also be that you fled the scene or did not have enough insurance to cover your injuries.

About 9% to 11% of vehicles on Georgia roads lack any type of insurance, making them at relatively high risk of being involved in a crash with an uninsured driver. Although a driver is required by rule to have insurance on the car he or she drives, he or she is not required to have uninsured motorist (UM) coverage.

Every driver must carry UM coverage on their car. If you purchase UM coverage, it automatically comes with underinsured coverage (UIM), which can give you additional compensation in case the at-fault driver's insurance limit is not enough to cover your damages. UIM is also useful in providing more compensation, when there are multiple victims with injuries.

In any case, it is not always the choice to purchase UM/UIM coverage. If you are not sure whether you have purchased this optional insurance, you can consult your insurer. If the company has given you written notice indicating that it expressly rejected UM/UIM coverage at the time you purchased your automobile insurance policy. If that's not the case, you have that UM/UIM coverage even if you didn't know you had it.

What does the UM/UIM cover?

We are going to refer to UM and UIM, since, in practical terms, they are the same. If you have UM coverage, then your claim is against your own insurer once the at-fault driver's lack of insurance is verified. When the accident has a hit and run component, then you should immediately notify the police and obtain a police report to give to your insurer. You will also need to promptly notify your own insurer, or you may lose coverage. It must also show the physical damage caused by the hit-and-run driver. If there was no contact with your car, but you claim that the other driver's reckless driving caused you to swerve or lose control of your vehicle and crash, you will need credible corroborating testimony or even surveillance video of what happened. occurred.

Who does UM cover?

UM insurance will also cover you if you have been injured as a pedestrian or bicyclist in a hit-and-run accident. You don't need to be in your car to collect your UM insurance. This insurance also covers accidents outside the State of Georgia. In case you are in an accident, for example, in Texas or Florida, your UM insurance will be there to protect you.

UM coverage is also provided to:

- Your spouse who lives in your home

- Any relative of you or your spouse who resides in your home

- People who have driven your car with your express or implied consent

- Any guest other than a family member traveling as a passenger in your vehicle

If at the time of the traffic accident, you were a passenger and not related to the driver in an uninsured accident, first seek your own UM coverage, if you have it. Otherwise, you can seek coverage from a relative who lives in your home and who may own it. If neither you nor any resident relative have UM coverage, then you can use the driver's policy if you have such coverage.

It is always a good idea to carry more than the minimum policy limits for your liability coverage and for your UM/UIM protection. In case your own injuries are serious and those of your passengers are also serious, the limits of $25,000 or even $50,000 in UM/UIM will probably be insufficient.

UM/UIM coverage types

In the State of Georgia, UM/UIM coverage with your liability policy has several categories:

Traditional UM/UIM coverage: This is traditional UM/UIM coverage, also known as “step-down” coverage, which applies whenever your damages exceed the limits of the defendant's policy. It should be noted that your own UIM coverage must be greater than the limits of the defendant's policy. For example, in the event that the defendant's policy limits are exhausted by $100,000, then you can request additional compensation under your UM provision, provided that your policy limits exceed the defendant's limits of $100,000. In case you have a UM in the amount of $300,000, then you will have an additional $200,000, since the first $100,000 is offset by the defendant's contribution.

Your insurance company will have to explicitly demonstrate that you chose traditional UM coverage. If you cannot provide such proof, then you have something called “stacking,” which means stacking the coverages for each of your own or your resident family members' separately covered vehicles. It should also be noted that the coverage will be equal to whatever your liability limits are. It is exactly proportional: if it is $100,000, then your UM/UIM coverage will also be $100,000.

Additional UM/UIM Coverage – This insurance means you can add your UIM insurance to the amount you collect from the defendant. It will provide you with additional UM/UIM coverage, in case the defendant driver has insufficient policy limits. If for example, your damages are $900,000, but the defendant only has a policy for $250,000/$500,000.

If you have UM/UIM coverage for two vehicles owned by you and your spouse of $100,000 each; Your two children who live with you also have UM/UIM coverage of $100,000 each on their respective vehicles: If you choose the additional UM/UIM coverage and policy stack, then you are entitled to use 4 policies that have a total value of $400,000 in additional cumulative UIM coverage.

How do you charge for your UIM coverage?

Generally, but not always, the way it works is that once your attorney has reached an agreement with the defendant's liability insurer, you will have to sign a Limited Liability Release. This means that you are allowed to settle the claim against the liability carrier and retain your right to pursue UM carriers. If you sign a general release or if the language in the release is ambiguous, you risk losing your right to collect from UIM carriers as well as additional compensation. You need to make sure you do it correctly.

If you have questions about accidents involving drivers who do not have insurance, do not hesitate to contact Tovar Hastings Law, the agency with the best expert traffic accident attorneys in Atlanta and the State of Georgia. We have the best attorneys with extensive experience in these types of cases before the courts of Georgia. If you are considering taking out insurance and need advice from an attorney, do not hesitate to consult with Tovar Hastings Law and his law firm; In the event that you are involved as an affected party in a traffic accident in Atlanta, then it is time for you to contact us without any additional charge at our contact numbers.